In the heart of Southern Ethiopia, where the Arabian-Nubian Shield stretches across ancient terrains rich in mineral wealth, a new chapter in gold exploration is unfolding.

Just 100 kilometres from the prolific Lega Dembi Gold Mine—Ethiopia’s largest gold producer with over 4.5 million ounces mined—a promising gold project is drawing attention. The region’s geological pedigree, marked by extensive artisanal workings and historic drill intercepts, suggests untapped potential that could redefine the gold landscape in East Africa.

AJN Resources mobilises on the Okote Gold Project

AJN Resources Inc. (CSE:AJN), a Canadian junior miner, has officially commenced field operations on the Okote Gold Project following a joint venture agreement with Godu General Trading S.C., the licence holder. This move marks AJN’s entry into Ethiopia’s burgeoning gold sector, backed by a commitment to invest over $10 million toward exploration, resource definition, and feasibility studies.

This article is disseminated in partnership with AJN Resources Inc. It is intended to inform investors and should not be taken as a recommendation or financial advice.

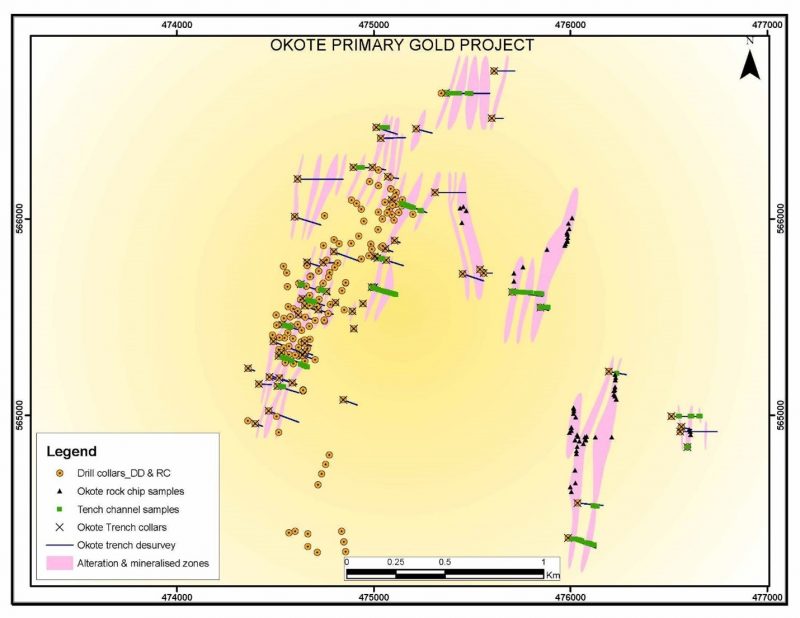

Field crews are now actively mapping and sampling across a 3,000m x 500m corridor of artisanal workings—areas that have never been drill-tested. These workings are believed to lie within a mineralised shear zone trending N-S to NNE-SSW, with quartz vein systems and disseminated pyrite hosted in schist and intrusive contacts. The geological setting is highly favorable, with mineralised shears exceeding 50 metres in width and small intrusive bodies of diorite, gabbro, and granite offering additional targets for gold mineralisation.

“Our experienced geological team will be focusing on mapping and sampling the extensive artisanal workings exposed over 3km where there has been no previous exploration,” the company’s CEO and president, Klaus Eckhof explained in a news release. “We eagerly await results from trench and grab samples which cover 3km of untested artisanal workings to the east of the area that has been drilled. We now have a month to map and sample all exposures including the area which has been covered by drilling and work out the optimum drilling programme to ensure that results support continuation of the Okote Gold Project.”

Strategic partnerships and technical execution

To accelerate exploration, AJN has engaged Mining and Drill Systems (MDS) of South Africa to conduct a minimum of 1,500 metres of diamond drilling. Mobilisation began on September 22, 2025, with drilling expected to commence within weeks afterward. This program will be guided by data from 600 trench and grab samples already submitted to ALS Global for analysis, as well as detailed logging of historic drill core stored in Addis Ababa.

Godu General Trading has played a pivotal role in facilitating local engagement, ensuring AJN has full support from government bodies, local communities, and artisanal miners. This collaboration guarantees unimpeded access to the project area, including newly exposed mineralised zones that span over 3 kilometres of strike length.

Why the Arabian-Nubian shield matters

The Arabian-Nubian Shield is one of the world’s most prospective geological belts for gold and base metals. Stretching across northeastern Africa and the Arabian Peninsula, it hosts numerous world-class deposits. Ethiopia’s Adola Gold Belt, where Okote is located, is a key segment of this shield, offering structural complexity and favorable lithologies for gold deposition.

AJN’s Okote Project benefits from this geological advantage, with early indications pointing to significant upside. Historical drill results from previous operators—though not yet validated by AJN—include intercepts such as 25.05m at 3.82g/t Au and 13m at 8.71g/t Au, underscoring the potential for high-grade mineralisation.

Investor outlook: A ground-floor opportunity

With gold prices surging over 40 per cent this year and increasing interest from junior miners in Ethiopia, AJN Resources is well-positioned to capitalize on this momentum. The company’s methodical approach—combining grassroots exploration, historical data validation, and strategic drilling—offers investors a compelling opportunity to participate in a potentially transformative gold discovery. Since the year began, AJN stock has risen more than 28 per cent.

As AJN advances its due diligence and prepares for drilling, investors are encouraged to monitor developments closely. The Okote Gold Project is not just another exploration play—it’s a gateway into one of Africa’s most promising gold belts, backed by strong local partnerships and a clear roadmap to resource definition.

Digging into the future

The boots are on the ground, the drills are on their way, and the data is flowing. For investors seeking exposure to early-stage gold exploration in a geopolitically stable and geologically rich region, AJN Resources Inc. offers a unique proposition. The Okote Gold Project could be the next big story in African gold—and now is the time to dig deeper.

Join the discussion: Find out what everybody’s saying about this stock on the AJN Resources Stock Forum, and check out the rest of Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.