The overlooked mineral

In the race to electrify transportation and secure energy independence, minerals like lithium, nickel, and cobalt dominate headlines. Yet, graphite—the largest component of a lithium-ion battery by weight—remains underappreciated. A standard EV battery contains more graphite than all other metals combined, making it indispensable to the energy transition.

Beyond civilian applications, graphite’s high thermal resistance, conductivity, and stealth-enhancing properties make it a strategic asset in defence and aerospace. Recognized by the U.S. Department of Defence (DoD) as one of the few minerals meeting all six industrial and defence sector indicators, graphite is now firmly in the spotlight as a critical material for national security.

Civilian demand – EVs and grid storage

The global push toward electrification is driving explosive demand for graphite. In 2024, natural graphite production reached ~1.3 million tonnes, while synthetic graphite added ~3 million tonnes. Yet, demand already exceeded 3.7 million tonnes, creating a supply gap that is widening rapidly.

This article is disseminated in partnership with Lomiko Metals Inc. It is intended to inform investors and should not be taken as a recommendation or financial advice.

Benchmark Mineral Intelligence forecasts a 140 per cent increase in natural graphite demand by 2030, requiring 31 new mines globally. With EVs projected to make up over 30 per cent of global vehicle sales by the end of the year, and grid-scale energy storage accelerating, graphite’s role as the “silent partner” of the energy transition is becoming impossible to ignore.

Defence demand – Military applications

Graphite’s strategic value extends deep into defence:

- Stealth technology: Radar-absorbent coatings for aircraft and drones.

- Thermal management: High-performance electronics and missile systems.

- Structural composites: Lightweight armor and aerospace components.

- Nuclear moderation: Graphite is used in reactors for its neutron moderation capabilities.

The U.S. DoD has responded by investing in domestic graphite supply chains, including grants under the Defence Production Act to secure high-purity graphite for military-grade lithium-ion batteries. With 100 per cent import dependence on graphite, the U.S. views this mineral as a national security priority.

Geopolitics – China’s grip

China controls over 65 per cent of natural graphite mining and more than 90 per cent of anode-grade graphite refining. In late 2023, Beijing imposed export controls on high-purity graphite, citing national security concerns. These controls now require special permits for graphite exports, impacting countries like the U.S., Japan, and South Korea.

This move has exposed vulnerabilities in Western supply chains. With qualification processes for battery-grade graphite taking years, the urgency to develop non-China sources has never been greater.

Canada as a solution

Amid this global scramble, Canada emerges as a stable, resource-rich, ESG-aligned alternative. With abundant natural graphite reserves and a strong regulatory framework, Canada is well-positioned to lead the charge in ethical mineral sourcing.

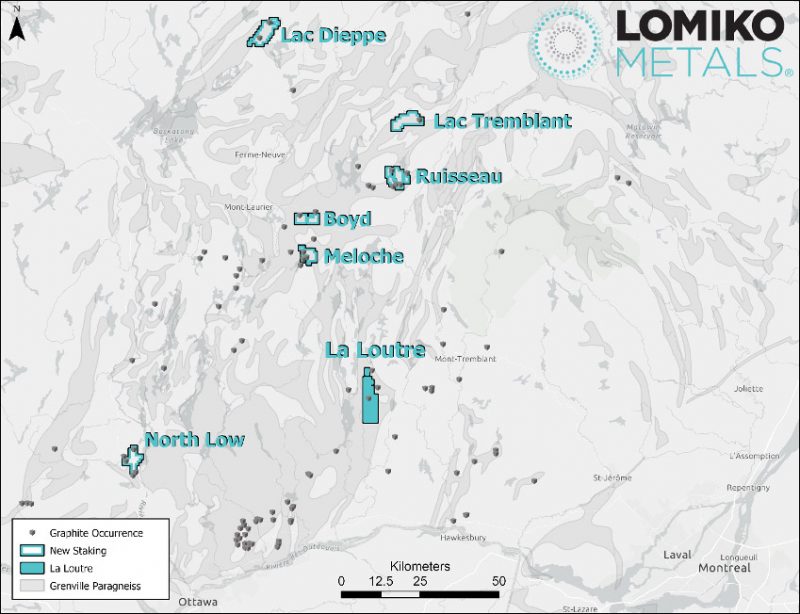

Enter Lomiko Metals Inc. (TSX.V:LMR)—a junior mining company with a world-class graphite deposit in southern Québec. Its flagship La Loutre project boasts 64.7 million tonnes of Indicated Resources averaging 4.59 per cent Cg, equating to 3 million tonnes of contained graphite.

Lomiko has received historic funding:

- US$8.35 million from the U.S. DoD

- C$4.9 million from Natural Resources Canada

These grants support feasibility studies and pilot processing to produce battery-grade anode material.

Lomiko continues to advance its ESG commitments, community engagement, and technical studies. Its ideal location near infrastructure and the U.S. battery corridor makes it a prime candidate for North American supply chain integration.

Join the discussion: Find out what the Bullboards are saying about Lomiko Metals and check out Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.