In a year defined by bold moves and drastic pivots, one emerging player in the battery metals space is making waves across North America.

With a major gold-copper acquisition in British Columbia, and multiple well situated lithium mining projects in Nevada, this company is rapidly building a portfolio that demands investor attention. Dive into the latest developments that could reshape the future of critical mineral and precious metal exploration.

This article is disseminated in partnership with Grid Battery Metals Inc. It is intended to inform investors and should not be taken as a recommendation or financial advice.

In 2025, Grid Battery Metals (TSXV:CELL) has demonstrated significant momentum in its mission to become a leading explorer of battery metals essential to the electric vehicle (EV) revolution. With a diversified portfolio spanning copper and lithium assets across Canada and the United States, the company has made notable strides in acquisitions, exploration, and solid partnerships that position it favorably for long-term growth.

A transformative copper-gold acquisition in British Columbia

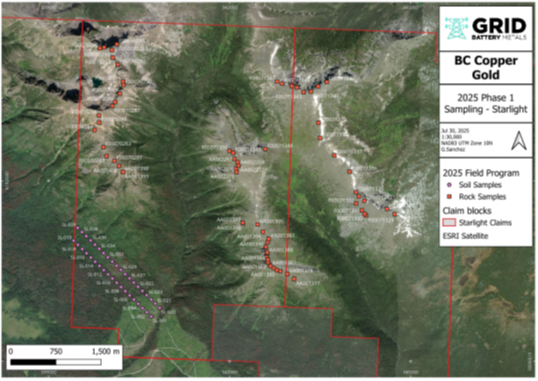

In March 2025, Grid Battery Metals finalized a pivotal acquisition of 17 gold and copper mineral claims totaling 275.25 square km. in North Central British Columbia from AC/DC Battery Metals Inc. This “related party” transaction, approved by the TSX Venture Exchange, involved the issuance of 5 million common shares at a deemed value of $0.05 per share and a payment of C$48,172.15 in staking costs.

In a media statement, the team explained that the acquired property lies in the prolific Omineca mining region, flanked by major copper-gold assets such as Centerra Gold’s (TSX:CG) Mount Milligan gold / copper mine and Kemess North project, and NorthWest Copper Corp’s (TSXV:NWST) Kwanika and Stardust gold / copper deposits. The region boasts robust infrastructure, skilled labor, and a mining-friendly regulatory environment, making it an ideal setting for exploration and development.

Fall 2025 exploration program: Hardline Exploration delivers

Two months later, the company awarded its fall exploration program to Hardline Exploration, a respected geological consulting firm based in Smithers, BC. Hardline is known for its collaborative approach with local contractors and First Nations, and its expertise in executing complex exploration programs.

The first phase of the fall program focused on the Jupiter and Starlight claim blocks. Activities included assaying, trenching, geophysical surveys, and soil sampling across eight targeted zones and builds upon recent exploration programs completed on the property over the past several years. These efforts aimed to specifically validate magnetic anomalies and geochemical signatures previously identified in 2023. Assay results from this initial exploration program are expected later in the season, with follow-up exploration already being planned.

“This area of the province has already generated several promising projects, and our land package is strategically situated to exploit the high gold-copper values of the region. NorthWest Copper Corp. on the nearby Kwanika project intercepted 400 metres of 1.01 per cent Copper equivalent. Nearby the Mount Milligan open pit gold-copper mine operated by Centerra Gold recently announced its pre-feasibility study that extended the life of its open pit ming by about 10 years,” Tim Fernback, Grid’s president and CEO said in a news release. “The area has proven itself to be a great place to look for both gold and copper. British Columbia is well known to be a safe and mining-friendly jurisdiction with reasonable government permitting processes and great mining infrastructure.”

Texas Springs Lithium Project: Promising results in Nevada

Grid’s Texas Springs Property in Elko County, Nevada, continues to show strong potential. The Phase 1 exploration program yielded average lithium grades of 2,010 ppm, with peak values reaching 5,610 ppm using a 1,000 ppm cut-off. These results are on-trend with neighboring Surge Battery Metals’ Nevada North Lithium Project, which has reported grades as high as 8,070 ppm. The Nevada North Lithium Project is North America’s highest grading lithium clay deposit.

The property is situated in the Granite Range and targets lithium-rich clays within volcanic tuffaceous sediments of the Humbolt Formation. Grid’s methodical approach, including soil sampling and CSAMT geophysical surveys, has identified promising zones for future drilling.

Clayton Valley Lithium Project: Advancing toward resource definition

Grid also owns 113 lithium lode and placer claims covering over 9.3 square km. in Clayton Valley, Nevada. This basin is well-situated and adjacent to Albemarle Corp.’s (NYSE:ALB) Silver Peak Mine—the only producing lithium brine operation in North America.

In autumn 2024, Grid completed a five-hole reverse circulation drilling program totaling 1443 metres. The program confirmed the presence of lithium-bearing claystones and geothermal features such as travertine and tufa, which are indicative of lithium mobilization. The company is now preparing for a maiden resource calculation and a NI 43-101 Preliminary Economic Assessment.

Portfolio optimization: Volt Canyon Property dropped

In a strategic move, Grid Battery Metals announced it has dropped its Volt Canyon Lithium Property from its portfolio. Initial sampling results were deemed average, and access challenges limited the project’s viability. This decision reflects the company’s disciplined approach to capital allocation and focus on high-potential assets.

A compelling case for investor due diligence

Grid Battery Metals Inc. has emerged in 2025 as a dynamic and forward-thinking exploration company. With successful acquisitions, promising exploration results, and solid partnerships, the company is well-positioned to capitalize on the surging demand for copper and lithium—two metals critical to the global energy transition.

Investors seeking exposure to precious metals, like gold, and critical metals, like copper and lithium, should consider Grid Battery Metals as a compelling opportunity. The company’s diversified asset base, technical expertise, and commitment to responsible exploration make it a standout in the junior mining space. As assay results and resource estimates unfold, now is the time for investors to deepen their due diligence and monitor Grid’s trajectory closely.

Join the discussion: Find out what the Bullboards are saying about Grid Battery Metals and check out Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.