- Hemisphere Energy Corporation (HME) is renewing its normal course issuer bid

- Between July 14, 2022, and July 13, 2023, the company may purchase up to 8,905,836 common shares

- Hemisphere is a Canadian oil company

- Hemisphere Energy Corporation (HME) opened trading at C$1.49

Hemisphere Energy Corporation (HME) is renewing its normal course issuer bid (NCIB).

Between July 14, 2022, and July 13, 2023, the company may purchase for cancellation up to 8,905,836 common shares representing approximately 10 per cent of its current public float.

Hemisphere Energy has retained Canaccord Genuity Corp. as its broker to conduct the NCIB on its behalf.

Purchases will be made on the open market through the facilities of the TSXV. Hemisphere will pay the prevailing market price for any shares purchased under the bid.

The company believes that purchasing common shares for cancellation will increase the proportionate interest of all remaining shareholders.

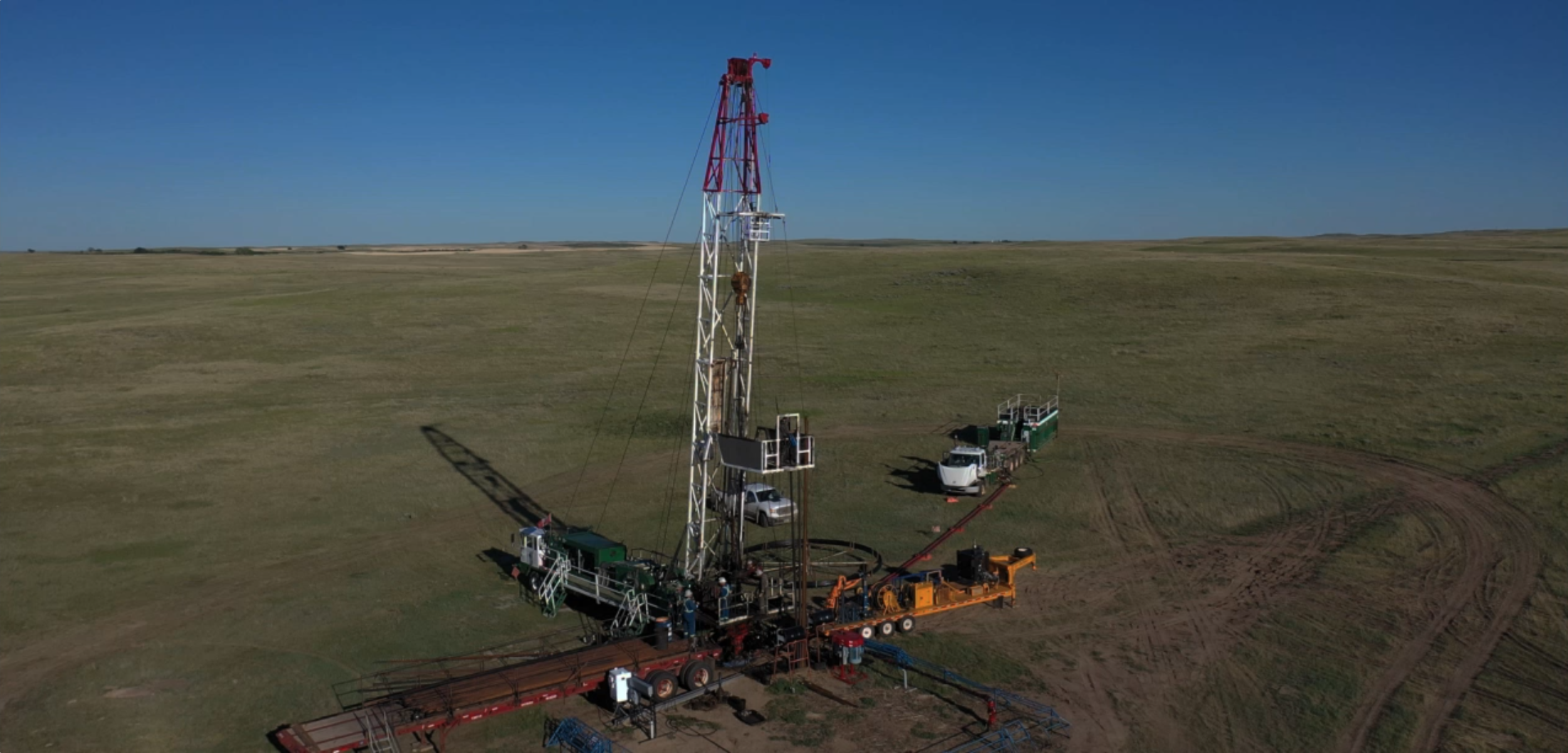

Hemisphere is a Canadian oil company focused on the sustainable development of its high netback, low decline conventional heavy oil assets through water and polymer flood enhanced recovery methods.

Hemisphere Energy Corporation (HME) opened trading at C$1.49.