- Labrador Uranium (LUR) has signed an agreement with ValOre Metals Corp. to acquire ValOre’s Angilak Property in Nunavut by a plan of arrangement

- The acquisition of the Angilak Property will add a large, high-grade uranium project in Nunavut

- When the arrangement is completed, Labrador Uranium Inc. will change its name to “Latitude Uranium Inc.” to reflect its expansion within Canada

- In connection with the arrangement, LUR plans to execute a concurrent private placement for gross proceeds of $ 4 million

- John Jentz will be appointed as CEO of the company

- Labrador Uranium Inc. (LUR) opened trading at $0.40 per share

Labrador Uranium (LUR) has signed an arm’s length definitive agreement with ValOre Metals Corp. to acquire Angilak Property.

LUR will acquire ValOre’s Angilak Property in Nunavut by way of a court-approved plan of arrangement.

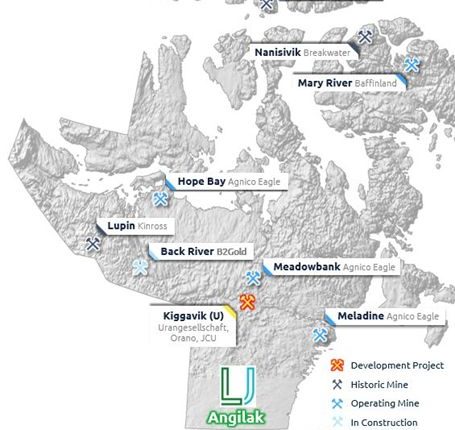

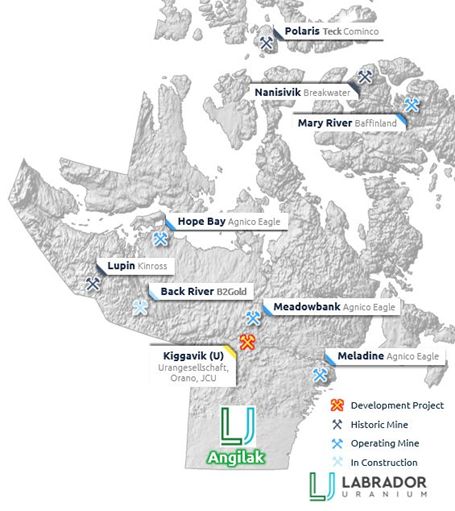

The acquisition of the Angilak Property will add a large, high-grade uranium project in Nunavut. It will also expand LUR’s exposure to proven uranium camps in Canada with district-scale potential.

In addition, it provides the ability to leverage LUR’s existing team with extensive experience in Canadian uranium exploration, including technical expertise, corporate and board.

When the arrangement is completed, Labrador Uranium Inc. will change its name to “Latitude Uranium Inc.” to reflect its expansion within Canada.

“This announcement represents a giant step forward in LUR’s strategy to become a premier uranium exploration company in Canada,” said Philip Williams, Executive Chairman of LUR.

“Assets like Angilak are few and far between, boasting both high uranium grades with upside to other commodities that are also important to the clean energy transition like molybdenum, silver and copper,” he added.

ValOre will transfer and assign its interest in the Angilak Property to a new wholly-owned subsidiary of ValOre formed solely for the purpose of facilitating the arrangement.

Following completion of the transfer, LUR will acquire from ValOre all of the issued and outstanding common shares of VO Subco. ValOre will receive $3,000,000 in cash and 100,000,000 common shares of LUR at a deemed price of $0.40 per share, and the consideration shares will be distributed to the holders of common shares of ValOre on a pro-rata basis.

In connection with the arrangement, LUR has signed an engagement letter with a syndicate of underwriters to execute a concurrent private placement.

The offered securities may be sold in any combination provided that the concurrent private placement consists of a minimum of 11,428,572 subscription receipts for gross proceeds of $4.0 million.

LUR has granted the underwriters an option to purchase for resale additional subscription receipts to raise additional gross proceeds of up to $2,000,000.

In connection with the arrangement, it is expected that John Jentz will be appointed as Chief Executive Officer and a Director of the company and that Philip Williams will be stepping down as Interim Chief Executive Officer but will continue to serve as Executive Chairman and Director of the company.

Jentz is a seasoned mining professional, having held operational, investment banking and board of director roles across the mining industry.

Labrador Uranium Inc. is engaged in the exploration and development of uranium projects in Labrador, Canada and holds a dominant land position with 52 Mineral Licences covering 152,825 ha in the prolific Central Mineral Belt in central Labrador and the Notakwanon Project in northern Labrador.

Labrador Uranium Inc. (LUR) opened trading at $0.40 per share.