As we’ve depicted in the Less-than-Truckload and Logistics & Warehousing portions of this three-part series, Mullen Group (TSX:MTL) is one of Canada’s largest logistics companies, facilitating the movement of essential goods to thousands of communities across North America, while generating growing revenue and consistent profitability over the past decade, making MTL stock significantly undervalued at its 40 percent loss since 2015.

The final two business segments behind Mullen Group’s exemplary financial performance – Specialized & Industrial Services and U.S. & International Logistics – contribute to the company’s value proposition by diversifying its leading positions in logistics and transportation across additional essential services and high-demand geographies, each approached with the company’s signature focus on acquisitions with strong cultures, brands and long-term growth runways.

Mullen Group’s Specialized & Industrial Services segment

Mullen Group’s Specialized & Industrial Services (“S&IS”) segment is comprised of unique businesses in sectors of the Canadian economy that require specialized equipment and services including the natural resources, energy, infrastructure and construction sectors.

Our S&IS segment business units provide a wide range of service offerings including water management, environmental reclamation services, turnaround services and industrial maintenance, services that support the drilling of wells, well servicing and fluid hauling associated with the oil and gas industry in western Canada, along with transportation and logistics services for complex pipeline and industrial projects. Our business units are strategically situated throughout western Canada and operate fleets of highly specialized equipment, generating superior returns on capital employed over the long term.

The S&IS segment is further broken down into three segments: Production Services, Specialized Services and Drilling & Drilling-Related Services.

The segment has approximately 1,500 personnel spread across 15 strategically located business units, whose combined financial performance is highlighted by:

- Contributing about 22.9 percent of Mullen’s annual revenue, according to the company’s 2024 Annual Financial Review.

- Revenue growth from C$362 million in 2020 to C$457.1 million as of Q4 2024.

- An average of C$80.4 million in annual operating income before depreciation and amortization (OIBDA) over the period at a 20.1 percent margin.

- An average of only 1.6 in net capital expenditures as a percentage of revenue.

These value-accretive figures are spearheaded by established brands well-versed at transforming specialized equipment expertise into long-term returns on capital.

Production Services

Business units in the Production Services category provide a broad range of specialized services related to the processing and production of both light and heavy oil as well as natural gas liquids in western Canada. Certain business units in this category provide full-service offerings to companies utilizing fracking techniques. Service offerings also include industrial cleaning and turnaround services. Mullen Group currently has four business units that provide services in this area.

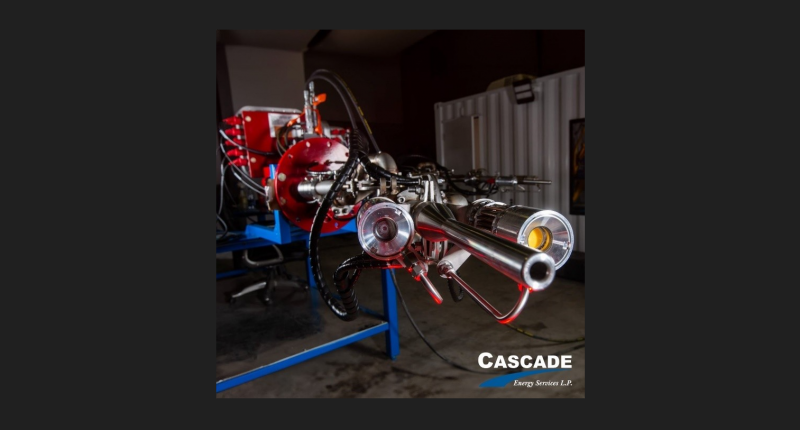

Cascade Energy Services, founded in 1997, was acquired by Mullen Group in 2008. Cascade Energy provides a wide range of production services, turnaround, pressure pipeline testing, industrial cleaning services and chemical solutions to the energy, utility, mining and construction industries in northern British Columbia, Alberta and southwestern Saskatchewan. Cascade Energy employs approximately 200 employees and contractors, and has 228 power units and 419 trailers. Its fleet is comprised of specialized trucks and auxiliary equipment including hydrovac trucks, combo units, vacuum trucks, pressure trucks, hot oiler units, steam trucks and on-site frac water storage with 500 barrel mobile frac tanks and frac corrals (ranging in size from 3,200 cubic metres to 7,200 cubic metres). In 2020, Cascade Energy added zero entry tank cleaning equipment capabilities to its service offering designed to support large industrial tank cleaning for customers in the midstream sector.

In addition to Cascade Energy, Mullen Group’s Production Services segment includes the following business units:

Specialized Services

Business units in the Specialized Services category primarily provide services to Canada’s natural resources and infrastructure sectors such as pipeline, construction, petro-chemical, utility & telecom and oil & natural gas, as well as municipalities. Service offerings include dredging and dewatering services, oversize and overweight transportation services, the transportation, stringing and stockpiling of large-diameter oil and natural gas transmission pipe, civil construction, environmental services, industrial cleaning and turnaround services, emergency support services, and OEM parts and service dealer services. Mullen Group currently has five Business Units that provide services in this area.

Canadian Dewatering was formed in stages by Mullen Group acquiring Northern Underwater Systems (N.U.S.) Ltd. in 2004 and combining it in 2006 with the then newly acquired Canadian Dewatering Ltd. Canadian Dewatering provides fluid management services to the energy, mining, construction, pipeline, utility and petro-chemical industries along with infrastructure, environmental and emergency response services to municipalities in western Canada.

In addition to their fleet of portable engineered barges and portable dredges, Canadian Dewatering also operates its commercial diving operations across western Canada through its Northern Underwater Systems division.

Canadian Dewatering further stands out in the marketplace with one of the largest inventories of rapid-deployment hose and mobile industrial Tier 4 grade pumps in western Canada, and has built a track record of reliable response during natural disasters, including the Fort McMurray fires, Prince Albert oil spill and Southern Alberta flood relief initiative.

Other brand name business units in the Specialized Services segment include:

Business units in the Drilling and Drilling-Related Services category service the upstream market, which refers to oil and natural gas exploration, drilling and well completions. As such, these business units are highly reliant upon the levels of drilling activity and capital expenditures made by exploration and production companies. The direct services provided include the warehousing, transportation, handling and storage of oilfield fluids, drilling mud and tubulars, rig relocation services and general oilfield hauling. Mullen Group currently has six business units that provide services in this area.

Mullen Oilfield Services L.P. (“Mullen Oilfield“) was part of Mullen Group’s founding operations. It has expanded through the purchase of equipment, terminals and companies since first commencing operations. Mullen Oilfield is proud of its 155 employees who work hard to provide a variety of specialized oilfield transportation services to companies drilling for oil and natural gas in western Canada, most notably rig moving. This involves the dismantling, hauling and rigging up of drilling rigs in challenging, difficult, mountainous terrain and extreme weather conditions.

In 2020, the services of Mullen Oilfield were expanded to include the transportation, handling, storage and computerized inventory management of OCTG for the oil and natural gas industry as well as general oilfield hauling. Mullen Oilfield provides its clients with access to a web-based inventory management system developed by Mullen Group known as PipeOnLine, allowing them to track their oilfield tubular products in real time.

Other best-in-class business units in the Drilling and Drilling-Related Services segment include:

Mullen’s growth strategy for its S&IS segment focuses on technological advancements, with eyes on strengthening its edge in target industries to better capitalize on fluctuations in commodity prices and demand.

Mullen Group’s U.S. & International Logistics segment

Rounding off our Mullen Group overview, we turn to the company’s fourth and smallest segment, U.S. & International Logistics, which offers a robust set of third-party logistics (3PL) services to over 2,700 customers in Canada, the United States and Mexico through a combination of professional representatives and a network of independently owned and managed Station Agents (274 personnel in total), utilizing over 6,000 certified sub-contractor carriers.

HAUListic, the segment’s sole business unit acquired in 2021, houses a proprietary integrated transportation management platform, branded as SilverExpressTM. Notable features of SilverExpressTM include real-time information delivery to customers and carriers, price and capacity discovery, as well as tracking and tracing capabilities. SilverExpress’TM value-added services have driven substantial financial growth, with revenue increasing from C$118.2 million in 2021 to C$184.5 million year-over-year as of Q4 2024. This growth represents approximately 9 percent of total company revenue, an average annual operating margin of 2 percent and an operating margin as a percentage of net revenue of 17.1 percent over the period.

The U.S. & International Logistics segment continues to lay the groundwork for long-term growth, diversifying away from Mullen’s core asset-based operations to non-asset, technology-driven revenue. The segment’s low-cost structure is expected to enhance company-wide operating margins as it scales into the billion-dollar 3PL market, which is projected to grow at an estimated 9.2 percent compound annual growth rate (CAGR) through 2030.

Mullen Group’s proven acquisition strategy has long-term potential

Mullen Group’s proven acquisition strategy offers significant long-term growth potential. Our three-part overview reveals a company engaged in essential industries such as transportation, logistics, mining and energy, with a long history of acquiring companies in the transportation and logistics industries and one of the largest portfolios of logistics companies in North America. Over the past 70 years, the company has distinguished itself as an astute capital allocator, prioritizing value for employees and stakeholders alike.

Since becoming a public company in 1993, Mullen has completed just shy of 95 acquisitions, each selected for its people-focused management and potential for long-term, value-accretive growth. The company’s ability to identify untapped market share has resulted in an over 11 percent revenue CAGR since 1993, supported by consistent free cash flow, over C$650 million in high-quality real estate (historical cost), and a steadfast focus on margin expansion through process improvements and tuck-in acquisitions. This strategy continually fortifies the company’s resilience, irrespective of economic cycles.

With over C$126.3 million in cash and C$525 million in borrowing capacity, Mullen is well-positioned to capitalize on acquisition opportunities that meet its precision-based acquisition strategy of the right fit, right price and right synergies. A declining interest rate environment may also enhance consumer and business sentiment, further supporting Mullen’s profitable growth trajectory. This momentum is likely to drive a revaluation of the company’s share price, underscored by its established role in the essential flow of goods that underpin daily life.

Join the discussion: Discover what others are saying about this logistics stock and its compelling value proposition on the Mullen Group Ltd. Bullboard. Additionally, explore other stock forums and message boards on Stockhouse.

This sponsored content is issued on behalf of Mullen Group Ltd. Please see the full disclaimer here.

(Top photo of a Cascade Energy Service zero entry tank cleaning canon: Mullen Group)