- Nintendo (OTC:NTDOY) moved higher after releasing its financial results for its Q2 for fiscal year 2025.

- The Japanese gaming giant announced a reduction in its sales forecast for the Switch, now expecting to sell 12.5 million units for the fiscal year ending March 2025, down from a previous estimate of 13.5 million units

- For the quarter ending September 30, Nintendo reported approximately US$1.8 billion in revenue slightly above the expected US$1.7 billion

- Nintendo stock (OTC:NTDOY) opened trading at US$12.87 per share

Nintendo (OTC:NTDOY) stock moved higher early Wednesday after releasing its financial results for its Q2 for fiscal year 2025.

After taking an earlier hit once the news broke, the Japanese gaming giant’s stock opened on the OTC market more than 2.5 per cent higher.

Nintendo revealed significant challenges as demand for its aging Switch console continues to decline. The Japanese gaming giant announced a reduction in its sales forecast for the Switch, now expecting to sell 12.5 million units for the fiscal year ending March 2025, down from a previous estimate of 13.5 million units. This marks a notable shift as the console enters its eighth year on the market.

Financial highlights

For the quarter ending September 30, Nintendo reported:

- Revenue: ¥276.7 billion (approximately US$1.8 billion), slightly above the expected ¥273.34 billion.

- Net Profit: ¥27.7 billion, significantly lower than the anticipated ¥48.06 billion.

- Year-on-year revenue fell by 17 per cent, while net profit plummeted by over 69 per cent compared to the same period last year.

The decline in sales is attributed to the aging Switch console, which, despite being Nintendo’s second best-selling console in history, is experiencing reduced consumer interest. In the first half of the previous fiscal year, sales were buoyed by the success of the “Super Mario Bros. Movie” and the release of “The Legend of Zelda: Tears of the Kingdom.” However, Nintendo noted that there were “no such special factors” in the current fiscal year, leading to a significant drop in both hardware and software sales.

In the six months ending September 30, Switch sales totalled 4.72 million units, down from 6.84 million units in the same period last year.

Strategic adjustments

In light of these challenges, Nintendo has also revised its full fiscal year forecasts for sales and operating profit. The company now expects:

- Sales: ¥1.28 trillion, down from ¥1.35 trillion.

- Operating profit: ¥360 billion, reduced from ¥400 billion.

Investors are keenly awaiting news regarding a successor to the Switch, which Nintendo has indicated will be announced within the current fiscal year. This potential new console is seen as a critical factor in revitalizing Nintendo’s gaming business.

Backwards compatibility and future prospects

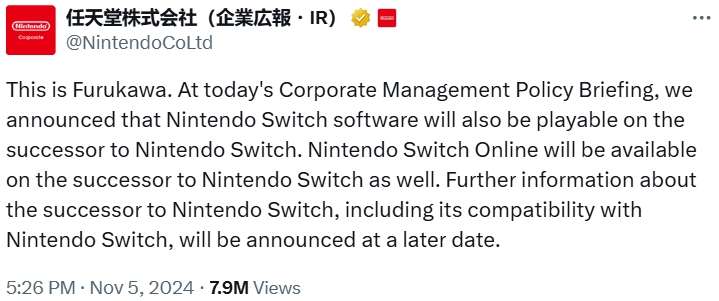

In a post to Twitter/X, Nintendo has confirmed that the upcoming successor to the Switch will feature backwards compatibility, which would let players enjoy their existing library of games on the new, more powerful console. This move is expected to ease the transition for consumers and maintain engagement with Nintendo’s extensive catalog of titles.

In response to declining sales, Nintendo is also exploring new avenues for its intellectual property, including licensing for movies and theme parks. A new “Super Mario” movie is scheduled for release in 2026, which could further enhance brand visibility and consumer interest.

Stock performance

As of now, Nintendo’s stock has faced volatility this year, reflecting investor concerns over the declining sales of the Switch and the anticipated transition to a new console. The company’s ability to navigate these challenges and successfully launch a successor will be crucial for restoring investor confidence and driving future growth.

While Nintendo’s Q2 results highlight significant hurdles at this stage in the game for such old hardware, it has enough on the table to last until the next shareholder call. By the time the team makes word official of the new console’s release, the hype alone should give it a boost.

With headquarters in Kyoto, Japan Nintendo Co., Ltd. is a multinational video game company that develops, publishes and releases video games and video game consoles.

Nintendo stock (OTC:NTDOY) opened trading at US$12.87 per share on the OTC Pink market, where it has risen 1.36 per cent year to date and is up nearly 16 per cent since this time last year.

Join the discussion: Find out what everybody’s saying about this stock on the Nintendo Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.(Top image: File)