- PyroGenesis (TSX:PYR), an ESG stock focused on electric plasma torches, has signed a first-phase C$1 million contract with a graphite producer to design a pilot-scale plasma reactor and testing system

- The contract adds to the company’s trillion-dollar addressable market

- PyroGenesis offers advanced plasma processes and sustainable solutions that reduce greenhouse gases

- PyroGenesis stock last traded at C$0.82 per share

PyroGenesis (TSX:PYR), an ESG stock focused on electric plasma torches, has signed a first-phase C$1 million contract with a graphite producer to design a pilot-scale plasma reactor and testing system.

Should PyroGenesis demonstrate that it can produce graphite at pilot scale, the partners will move on to the contract’s second phase and begin development of a full-scale graphite production plant.

PyroGenesis will receive a 10 per cent royalty on the first plant’s production and 5 per cent on any subsequent plants, and will serve as exclusive plasma supplier and engineering service provider during the contract.

The Canadian government has identified graphite as a critical mineral because of its essential role as an electrical conductor in EV battery anodes, in addition to serving as a key component in everything from brake linings, metal casting wear, metal foundry lubricants, and of course, pencils. Its varied uses afforded graphite a global market of US$23.73 billion in 2022, with Statista forecasting 58.7 per cent cumulative growth to US$37.68 billion by 2028.

What an investment in PyroGenesis looks like today

Investors in PyroGenesis gain exposure to the company’s three-tiered solution ecosystem that taps into the economic drivers of heavy industry. The contract above aligns with the commodity security and optimization tier, which focuses on the production or recovery of critical metals.

PyroGenesis has spent its more than 10-year history as a public company growing into large markets tied to heavy industry, as recently highlighted by fumed silica, aluminum, aerospace and biofuel, granting it a trillion-dollar addressable market keen to replace fossil fuels with electrical solutions such as the company’s plasma torches.

Despite a consistent track record of landing new contracts with global leaders in their industries, PyroGenesis has been unable to guide its operations into consistent growth or profitability, as you can see based on its past five years of income statements on Stockhouse.

Nevertheless, shareholders remain optimistic about contracts turning into greater revenue and scale, having been rewarded with a 60.78 per cent return since 2019 and a more than 1,200 per cent return since 2011, well ahead of the TSX’s 41.19 per cent and 76.08 per cent returns, respectively.

Leadership insights

“Graphite is considered to be a critical mineral that is widely used across manufacturing. It is used in the production of numerous essential materials and products including glass and steel, as well as in the processing of iron, the creation of batteries and pencils, automotive brake linings, and even in some nuclear reactor cores,” P. Peter Pascali, PyroGenesis’ president and chief executive officer, said in a statement. “In fact, graphite is so crucial that is has been labelled as one of the six minerals that have been prioritized in Canada’s Critical Mineral Strategy. In this program, graphite has been identified as having a distinct potential to spur Canadian economic growth due to its necessity as an input for priority supply chains. If we are successful in using plasma to extract and valorize graphite at the level that we believe we can, the road ahead for this unique production technique could be very rewarding. But one step at a time.”

“As I have often stated,” Pascali said, “PyroGenesis only commits to ideas that have both real and significant potential for successful commercialization. While we are approached regularly by companies seeking a technology partner, we will only commit our engineering and technical resources to those whose ideas have the most upside. We consider this news today to be one of those rare opportunities.”

About PyroGenesis Canada

PyroGenesis offers advanced plasma processes and sustainable solutions that reduce greenhouse gases.

PyroGenesis stock (TSX:PYR) last traded at C$0.82 per share.

Join the discussion: Find out what everybody’s saying about this ESG stock’s entrance into the graphite market on the PyroGenesis Canada Inc. Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

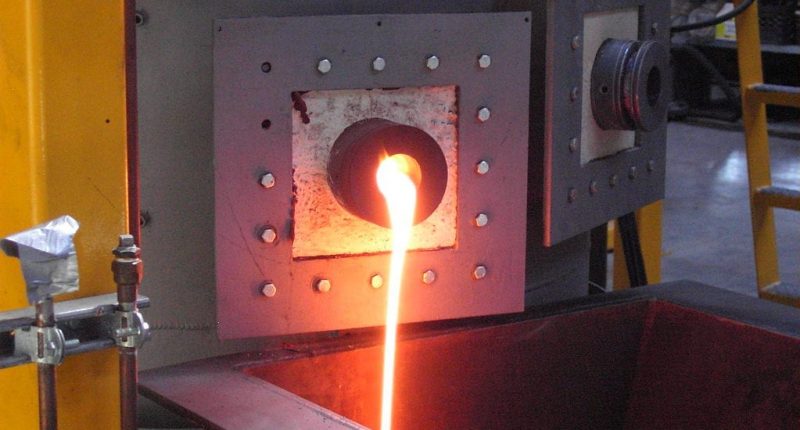

(Top photo of PyroGenesis’ Plasma Arc Gasification and Vitrification (PAGV) system, which converts incinerator ash and other hazardous inorganic material into an inert slag: PyroGenesis)