- Strathcona Resources (TSX:SCR) criticized MEG Energy’s (TSX:MEG) Board for endorsing the Cenovus (TSX:CVE) deal over its amended takeover bid, calling its offer “clearly superior” with a higher upfront premium and greater long-term upside

- Strathcona accused MEG’s Board of misleading shareholders, referencing similar claims made in a June circular, and released a new presentation to correct the record

- Strathcona urged MEG shareholders to vote against the Cenovus deal at the October 9 meeting and to accept its amended offer before the October 20 expiry deadline

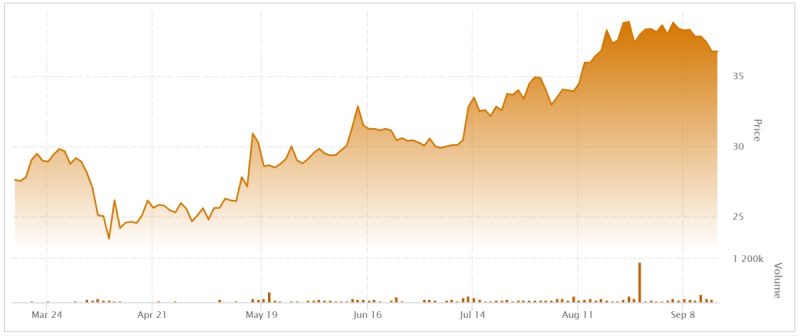

- Strathcona Resources stock (TSX:SCR) last traded at C$36.79

Strathcona Resources (TSX:SCR) made a strong response to MEG Energy Corp.’s (TSX:MEG) Board of Directors following its recommendation earlier this week for shareholders to vote in favour of the proposed arrangement with Cenovus Energy (TSX:CVE), and to reject Strathcona’s amended and extended take-over bid.

This content has been prepared as part of a partnership with Strathcona Resources Ltd. and is intended for informational purposes only.

In a statement released Tuesday, Strathcona expressed deep disappointment with MEG’s decision to reaffirm support for the Cenovus deal, even after the company tried to raised its offer to outbid Cenovus. Strathcona claims its amended offer, announced on September 8, is “clearly superior,” offering MEG shareholders both an upfront premium and the opportunity to participate in the future growth of a larger, more robust company.

Strathcona’s revised bid values MEG at C$30.86 per share, representing an 11 per cent premium over the Cenovus proposal. The offer includes 0.80 Strathcona shares per MEG share, which would give MEG shareholders 43 per cent ownership in the combined entity. In contrast, the Cenovus deal offers a mix of cash and shares, with MEG shareholders receiving only about 4 per cent ongoing exposure to the merged company.

Strathcona also criticized the MEG Board for repeating what it called “false and misleading claims,” similar to those made in the Board’s June 16 circular. To counter these claims, Strathcona has published a new presentation on its website aimed at “correcting the record.”

Next steps and shareholder action

Strathcona remains optimistic about shareholder support for its amended offer and thanked those who have already deposited their shares. The offer is set to expire at 5:00 p.m. MT on October 20, 2025, following MEG’s special shareholder meeting scheduled for October 9, where the Cenovus deal will be put to a vote.

Holding a 14.2 per cent stake in MEG, Strathcona confirmed it will vote against the Cenovus transaction, which requires 66 2/3 per cent approval from shareholders present in person or by proxy.

Strathcona is actively soliciting proxies and encourages MEG shareholders to vote against the Cenovus deal and to deposit their shares under the amended offer before the expiry deadline.

About the players in the game

Strathcona Resources Ltd. is Canada’s fifth-largest oil and gas producer with operations focused on thermal oil, enhanced oil recovery and liquids-rich natural gas. The company has three operations: Lloydminster Heavy Oil, Cold Lake Thermal and Montney Gas.

Cenovus Energy Inc. has oil and natural gas production operations in Canada and the Asia Pacific region and upgrading, refining and marketing operations in Canada and the United States.

MEG Energy Corp. is focused on sustainable in situ thermal oil production in the southern Athabasca oil region of Alberta.

Strathcona Resources stock (TSX:SCR) last traded at C$36.79 and has risen 16.76 per cent since the year began. Meanwhile, MEG Energy stock (TSX:MEG) has risen 21.82 per cent since the start of the year and last traded at C$28.75.

Join the discussion: Find out what the Bullboards are saying about Strathcona Resources, Cenovus Energy, and MEG Energy, then check out Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.