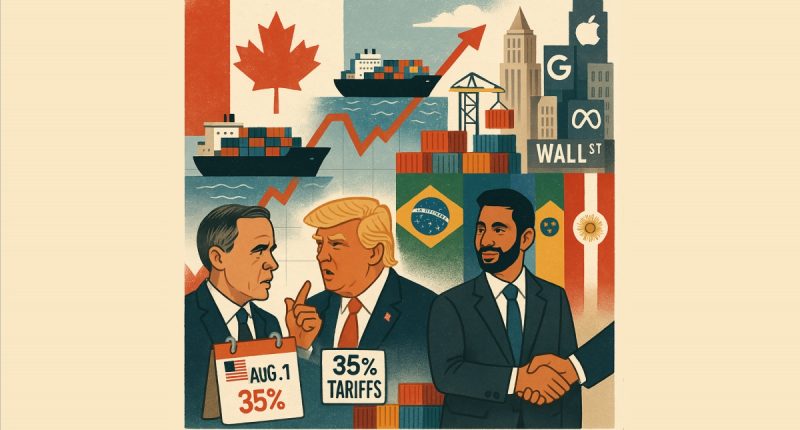

Canada’s main stock index took a hit on Friday, supported by encouraging domestic trade developments and US economic data that pointed to continued strength. International Trade Minister Maninder Sidhu highlighted growing interest in deepening trade negotiations with Mercosur—a South American alliance that includes Brazil, Argentina, Paraguay, and Uruguay—as part of Ottawa’s broader strategy to reduce reliance on US trade. Meanwhile, Prime Minister Mark Carney and his administration are engaged in discussions with US President Donald Trump, aiming to finalize a trade deal before the looming August 1 deadline, when 35 per cent tariffs are scheduled to be implemented. Earlier in the week, Carney introduced a steel tariff rate quota to shield Canada’s steel sector.

On Wall Street, markets were mixed though losses were mitigated by strong earnings reports from major banks and tech firms.

| TSX | 27,314.01 | -72.92 | |

| TSXV | 797.75 | +6.09 | |

| CSE | 126.84 | -0.44 | |

| DJIA | 44,342.19 | -142.30 | |

| NASDAQ | 20,895.66 | +10.01 | |

| S&P 500 | 6,296.79 | -0.57 | |

The Canadian dollar traded for 72.86 cents US compared to 72.76 cents US on Thursday.

US crude futures traded $0.12 lower at US$67.42 a barrel, and the Brent contract lost $0.20 to US$69.32 a barrel.

The price of gold was up US$12.94 to US$3,353.37.

In world markets, the Nikkei was down 82.08 points to ¥39,819.11, the Hang Seng was up 326.71 points to HK$24,825.66, the FTSE was up 19.48 points to ₤8,992.12, and the DAX was down 81.42 points to €24,289.51.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.