The precious metals recovery market in catalytic converters is poised to reach a market valuation of US$39.3 billion by 2025 alone, up from $24.7 billion in 2017, and companies like Regenx Tech (CSE:RGX) just might be an investor’s gateway into the market.

In the same vein, only 30 per cent of the precious metals from diesel catalytic converters are recovered which only further exacerbates the depletion of this resource. It is anticipated, then, that the diesel catalytic converter market will experience a compound annual growth rate of 8.10 per cent during the forecast period. However, a substantial challenge arises as most smelters reject these converters due to processing inefficiencies.

An increase in precious metals investments from emerging countries and demand from end-use industries contribute to the market’s growth.

The Regenx Tech advantage

With that in mind, Regenx Tech provides a unique offering in the sector unlike any other. With its headquarters out of Edmonton, Alberta, the company uses technology to recover precious metals from retired catalytic converters.

In an interview with The Market Herald Canada, Greg Pendura, CEO of Regenx Tech, explained that the company recovers platinum and palladium from end-of-life diesel catalytic converters, and does so in an environmentally friendly manner.

Previously known as Mineworx, the company changed its focus from mining to developing more environmentally friendly technology for the mining sector after it sold a mining asset in Spain.

The Regenx Tech solution

Although smelting has historically been the main commercial method in recovering platinum and palladium from diesel catalytic converters, they have limited capacity and are environmentally hazardous. They also are now hesitant to accept diesel catalytic converters due to processing inefficiencies, which is where Regenx Tech has the advantage.

“There are no competitors in the space right now,” Pendura told The Market Herald Canada. “The only other companies that can do [what we’re doing] are smelters, who would prefer not to process diesel catalytic converters.”

In fact, Regenx Tech plans to align itself with smelters in order to help its larger customers with diesel converters, which are not sustainable for smelting.

Breaking that down, Regenx provides a safe cleantech process that is a responsible way to recover precious metals from end-of-life products. The company’s innovative clean technology offers a solution, with a single plant featuring four modules, capable of recovering over 100,000 ounces of platinum and palladium from end-of-life catalytic converters annually.

Additionally, catalytic converters filter out and burn harmful emissions from exhaust gases in vehicles to improve a vehicle’s efficiency. That said, however, these emissions contribute to environmental pollutants, leading to a demand for catalytic converters.

He added that as it currently stands, roughly only 30 per cent of catalytic converters are recycled and the rest end up in landfills, resulting in a low percentage of recovery – that is, until Regenx Tech.

Case in point, Regenx Tech’s facility is the only commercially viable method of extracting precious metals from catalytic converters in an environmentally and sustainable way.

“[Regenx] will be the only alternative to smelters that are able to do this in a 100 per cent environmentally friendly manner,” Pendura told The Market Herald Canada. He explained that the company won’t be competing with smelters in any way because the newer diesel catalytic converters have a material called silicon carbide, which creates processing issues in furnaces.

Through Regenx Tech’s proprietary technology, the company will be able to precipitate precious metals into concentrate and recover roughly 90 per cent of the metals.

The complexity of the technology sets a high-level barrier to entry meaning Regenx has a solution to a global problem that is growing but very difficult for competitors to compete because of the proprietary technology involved.

With its shifting focus, the company then opened its first facility in Tennessee last year for the recovery of precious metals, which officially entered the commercial production phase in September.

As Regenx Tech prepares to scale up production at the Tennessee facility, the company presents itself as a unique investment opportunity unlike any other simply because there are no others like it in the space.

The facility in Tennessee

The company first announced the Tennessee facility in April 2023 after it received the occupancy permit, which allowed for the commissioning of Module 1 to begin. This process included the testing of all the components and began with processing smaller batches before scaling the technology up in stages to 100 per cent of its expected capacity to eventually 2.5 tons per day. Full capacity for Module 1 is imminent.

These plant builds are constructed in modular stages – and in this case, there will be four at Regenx Tech’s Tennessee facility – with each module having 2.5 tons of capacity. This will then translate to roughly $100 million in revenue per plant.

Pendura explained to The Market Herald Canada that the company has just completed building its first module, but that the plant is set up to have four modules in total. With each module having the capacity to produce 2.5 tons – or 10 tons per day of diesel catalytic converters – between each module.

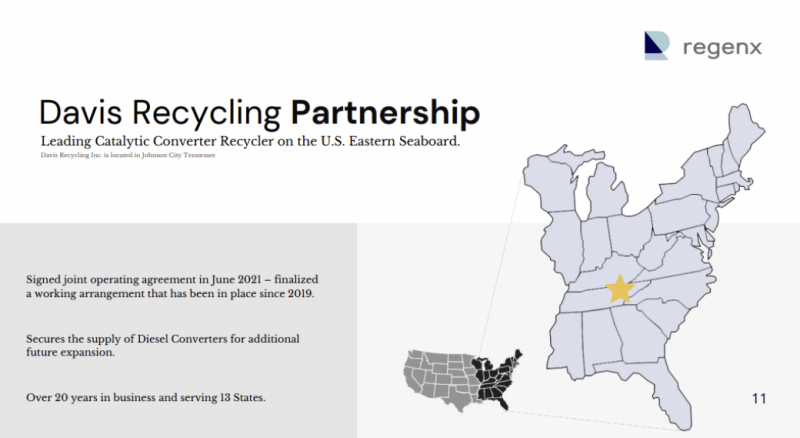

Of note, the company also has a joint venture in partnership with Davis Recycling, which is a full-service catalytic converter and scrap metal buyer located in Tennessee. The company explained that the partnership with Davis Recycling is for logistics and scale, while Capex is US $7 million for the 4-module plant and payback is less than 1 year.

Pendura told The Market Herald Canada that Davis Recycling is close to the company’s facility and that Davis’ 25-plus years of experience in the business is nothing short of beneficial to Regenx Tech.

“[Davis has] the supply chain management expertise from everything from procurement of the spent diesel catalytic converters to analysis, purchase and inventory,” he said.

Located in Greeneville, Tennessee, the facility spans 30,000 square feet and is the initial stage of the process where the shredding and grinding of the end-of-life catalytic converters occurs.

“[If the company is] doing 10 tons per day of material, Regenx is] recovering over 20 pounds of precious metals daily,” Pendura said. He added that because there’s an industrial use for the tailings in place, there won’t be any waste going to a landfill, which essentially means there won’t be any unnecessary waste, a zero environmental footprint.

Back in September, Regenx revealed an integral step in the installation of a larger gas line and permit approval, which will be vital moving forward as it transitions from the commissioning phase to commercial production to full capacity.

“With the successful installation of the larger gas line, [the company] is now poised to harness the full potential of [its] groundbreaking technology,” Pendura said at the time. “This accomplishment reaffirms our commitment to advancing innovation and reinforces our position as a pioneering force in the industry.”

Future outlook

As it currently stands, the company is focused on the Tennessee facility having recently completed the first module. Looking ahead, Pendura said the company anticipates scaling its production up to two-and-a-half tons per day by the end of Q1 2024 before its second module begins to be built.

“It takes about nine to 12 months from procurement to go into full-scale production, and once the company is halfway through the procurement process for module 2 the procurement process for modules 3 and 4 will commence,” Pendura said.

Once modules 3 and 4 are operational, Pendura said the company’s next logical step will be looking at locations for a facility in the western United States and eventually Canada for future facilities.

While Regenx Tech will focus on North America, it will be working on a licensing/royalty deal with a global company for overseas markets.

Beyond the technology

Regenx Tech told The Market Herald Canada that its technology falls in line with a greater purpose, which is a global movement towards environmental, social and governance (ESG) initiatives within the concept of a circular economy framework.

Carbon Credits will also become a source of secondary revenue for the company in the future. At present, Regenx Tech is investigating the requirements involved in entering the Carbon Credit space.

The process used by Regenx emits less CO2 into the atmosphere and is less energy intensive when compared to traditional mining and recycling by smelters. As such, this reduction in carbon footprint will allow the company to accrue Carbon Credits.

The management team

Greg Pendura, CEO

Greg Pendura is a CEO and an entrepreneur with over 35 years of experience founding, financing and advising emerging private and public companies. Following an early involvement in the service and manufacturing sectors, Pendura shifted his business interests in the mid-1990s to more environmentally focused enterprises.

Don Weatherbee, President

Don Weatherbee is the former CFO of Regenx Tech and was appointed as president of the company in late 2022. Weatherbee has been with the company for over eight years and has had extensive prior experience as a senior executive with mining related enterprises.

Emily Richardson, CFO

Emily Richardson joined Regenx Tech in fall of 2022. Richardson has a broad range of experience, including operating a public accounting practice, teaching at post-secondary institutions, and management roles in industry.

Investor’s corner

Regenx has spent years in research and development to get to the point of scaling and proving out this business model. The company is now entering a pivotal stage as it ramps up its commercial production in its very first module

As of the time of this writing, Regenx Tech has a market cap of approximately C$20 million and a share price of $0.05 with 352.31 million shares outstanding.

In other words, Regenx Tech is vastly undervalued given the size of the market it is tackling and given the fact that it’s the only company sustainably recovering precious metals. If that isn’t a selling feature, then I don’t know what is.

As Regenx Tech moves to ramp up commercial production at its Tennessee facility, it will be interesting to see how the tides start changing and what other companies, if any, will follow suit in the near future.

One thing’s for certain, though: Regenx Tech already has both feet firmly planted in the sector, making it one such company that investors don’t want to miss out on even well before its technology is meeting global demand.

Join the discussion: Find out what everybody’s saying about this stock on the Regenx Tech Corp. Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

This is sponsored content issued on behalf of Regenx Tech Corp., please see full disclaimer here.