Canadians’ infatuation with dividend stocks is wholly understandable. The idea of getting paid to wait as you hold a stock in your portfolio is innately attractive, appealing to human nature’s enduring preference for getting what it wants as soon as possible. However, a dividend does not make a stock desirable in itself.

This content has been prepared as part of a partnership with Vecima Networks Inc., Computer Modelling Group Ltd. and Pason Systems Inc., and is intended for informational purposes only.

The task of determining whether or not a dividend stock is suitable for you looks beyond the dividend towards the balance sheet, income statements and industry tailwinds, with the intention of valuing the underlying company versus the share price and assessing the conviction the dividend deserves for growing into the future.

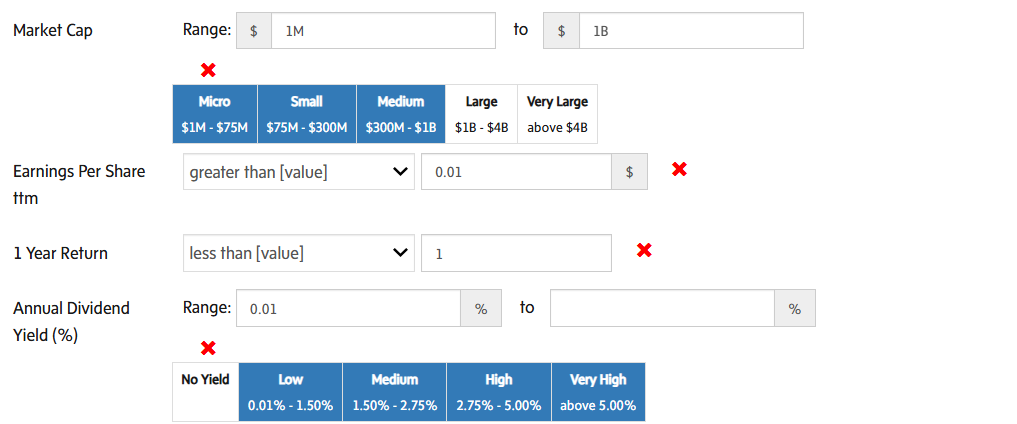

A straightforward way to conduct this assessment is to screen for Canadian dividend stocks that have fallen year-over-year, despite profitable operations on a net income basis, allowing you to delve into those with the highest losses in search of financials and prospects attractive enough to support a case for value. Here are three names that stood out.

Vecima Networks

After running the screen pictured below using The Globe and Mail’s online tool, the first compelling Canadian dividend stock I stumbled upon was Vecima Networks, market capitalization C$255.55 million, a cloud-based software and services leader pushing the boundaries of broadband speed, video quality, content distribution, as well as fleet tracking and intelligence.

Over its 35-year history, Vecima has grown to serve more than 100 operators and more than 100 million people globally, developing a competitive edge in the marketplace – see slide 26 of the May 2025 investor deck – but sees further growth ahead driven by the rapid evolution of network technology, with more than $500 million invested over the past decade to capitalize on an estimated $8 billion opportunity (slide 9).

Looking over the past five years, the company seems to be well on its way to claiming an increasing portion of this growth tailwind for itself, tripling revenue from C$94.88 million in F2020 to C$291.05 million in F2024, plus a solid C$63.98 million in Q1 F2025.

The company justified these sales by remaining profitable over the period, achieving more than 10x net income growth from C$1.81 million in F2020 to C$19.39 million in F2024. Exceptions include a C$330,000 loss in F2021 because of COVID-19 pandemic-related restrictions, and a C$7.89 million loss in Q2 2025 because of restructuring costs expected to result in C$17.5 million in cost savings.

From a dividend perspective, while Vecima has only increased its quarterly payout once since inception in 2014 – from C$0.045 to C$0.055 in 2015 – the company’s specialization in network connectivity places it at the leading edge of an increasingly digital world, one where network providers must upgrade their operations to command differentiated returns. Finding itself in such a privileged position, not to mention guided by a leadership team with 56 per cent insider ownership, the company deserves better than what its stock has delivered.

Vecima Networks stock (TSX:VCM) has given back 50.98 per cent year-over-year, last trading at C$10.51.

Computer Modelling Group

Another Canadian dividend stock that looks undervalued is Computer Modelling Group, market capitalization C$645.83 million, a global software and consulting company providing pioneering subsurface and surface solutions for oil and alternative energy clients in 60 countries around the world.

Over CMG’s more than 47-year operating history, the company has delivered decades of consistent cash flow and profitability, while building more than 450 long-term client relationships, granting it global brand recognition.

We can see this brand cachet at work over the past five years, which yielded revenue growth from C$67.36 million in F2021 to C$129.45 million in F2025, supported by controlled debt levels and consistent net income averaging more than C$20 million per year, setting the company up to self-fund future growth.

Over the short-term, management has responded to falling oil prices, lingering inflation and tariff-based instability by shifting from organic to inorganic growth, acquiring three companies since 2023 – most recently highlighted by SeisWare International – which are driving revenue and adjusted EBITDA and keeping the company in the black despite geopolitical uncertainty denting investor confidence.

Over the long-term, CMG’s imaging and reservoir simulation technology positions it to benefit from how about 70 per cent of remaining oil reserves are in geologically complex areas – see slide 3 of the Q4 2025 investor deck – favoring the achievement of further scale and pricing power.

These prospects bode well for CMG’s quarterly dividend, in place since 2013, which kept up a C$0.40 annual payout until 2020, when management cut it in half to weather the pandemic and re-establish the company’s ongoing path to growth, substantiating an ability to balance investment and shareholder returns as dictated by market conditions.

Struggling under energy demand uncertainty driven by US tariffs, Computer Modelling Group stock (TSX:CMG) has fallen by 43.47 per cent year-over-year, while remaining up by 52.12 per cent since 2020, undervaluing a history we have shown to be brimming with long-term value-creation potential. Shares last traded at C$7.79.

Pason Systems

Our final Canadian stock with dividend and value potential is Pason Systems, market capitalization C$918.17 million, whose underlying business – split into Intelligent Wellhead Systems and Energy Toolbase Software – is a global leader in data management systems for drilling rigs, covering data acquisition, wellsite reporting, analytics and remote communications. The company also provides products to model, control and monitor the economics and performance of solar and other energy storage projects.

Pason’ leadership position, built across a more than 40-year history, is anchored by a market presence of more than 70 per cent of drill rigs in the Western Hemisphere, but the company sees ample room to run thanks to the energy industry’s increasing technological adoption – see slide 12 of the Q1 2025 investor deck – as well as management’s proven skill at growing revenue in line with profitability.

Revenue grew by 2.64x from C$156.64 million in F2020 to C$414.13 million in F2024, followed by a strong C$113.18 million in Q1 2025. This was paired with mammoth 18.49x net income growth from C$6.57 million to C$121.5 million, respectively, followed by a respectable C$20.01 million in Q1 2025.

Looking further back, the numbers remain impressive, with Pason adding about C$100 million in revenue over the past decade, while delivering consistent free cash flow averaging more than C$50 million per year.

Pason believes it can deliver more growth, regardless of trade disputes or North American drilling activity (slide 9), thanks to its portfolio’s alignment with the energy industry’s secular technological trend, coupled with ongoing tailwinds behind solar and other alternatives.

As Jon Faber, president and chief executive officer, detailed in the Q1 2025 news release, “We anticipate that companies may adjust their development plans should their commodity price forecasts change; however, even in the event of reductions in capital programs, we expect any activity decreases to be more modest in both depth and duration as compared to previous industry slowdowns.”

“Our experience through previous cycles has been that maintaining investments focused on service quality and technology development through periods of uncertainty provides the greatest opportunity to expand competitive gaps,” Faber added. “We see opportunities for greater adoption of data-driven technologies over time in both drilling and completions, and we intend to ensure our product and service offerings continue to evolve to ensure we can capitalize on those opportunities.”

Given the Canadian technology leader’s long-term financials, even in the face of economic adversity, it’s reasonable to be optimistic about the company’s ability to continue delivering shareholder value and paying its quarterly dividend, which was established in 2013, cut drastically during the COVID pandemic, but has been growing steadily ever since from C$0.05 in 2021 to C$0.13 in 2025.

Pason Systems stock (TSX:PSI) has given back 24.18 per cent year-over-year but remains up by 96.50 per cent since 2020. Shares last traded at C$11.79.

Keen for more dividend content? Check out:

- Comparing Canadian small-cap dividend stocks to alternative income sources.

- The top 5 mining dividend stocks in Canada.

- Making a case for Canadian dividend stocks.

Join the discussion: Find out what investors are saying about these Canadian dividend stocks on the Vecima Networks Inc., Computer Modelling Group Ltd. and Pason Systems Inc. Bullboards, and make sure to explore the rest of Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.