Introduction

The copper market is currently facing a significant supply-demand imbalance. The global push towards electrification, particularly in electric vehicles (EVs) and renewable energy infrastructure, has dramatically increased copper demand.

This article delves into the factors driving this imbalance, the critical uses of copper beyond EVs, and why now is the opportune time to invest in copper. We will also explore the future price forecasts and the importance of one of the most exciting copper properties in British Columbia.

“If we are to meet energy transition targets, the amount of copper that’s going to be used over the next 28 years is going to exceed all of the cumulative copper consumption that the world has seen since 1900.”

John Mothersole, Market Intelligence

Copper supply and demand imbalance

Amid the uncertainty of ongoing tariff wars, the global demand for copper remains, and is set to surge, driven by the energy transition, infrastructure development, and technological advancements. According to the International Energy Agency (IEA), even under the most optimistic mining forecasts, we are facing a significant copper supply shortfall by the end of this decade, and by 2035, the demand for copper could reach almost 50 million metric tons annually. For perspective, copper mine production in 2024 was estimated at 23 million metric tons.

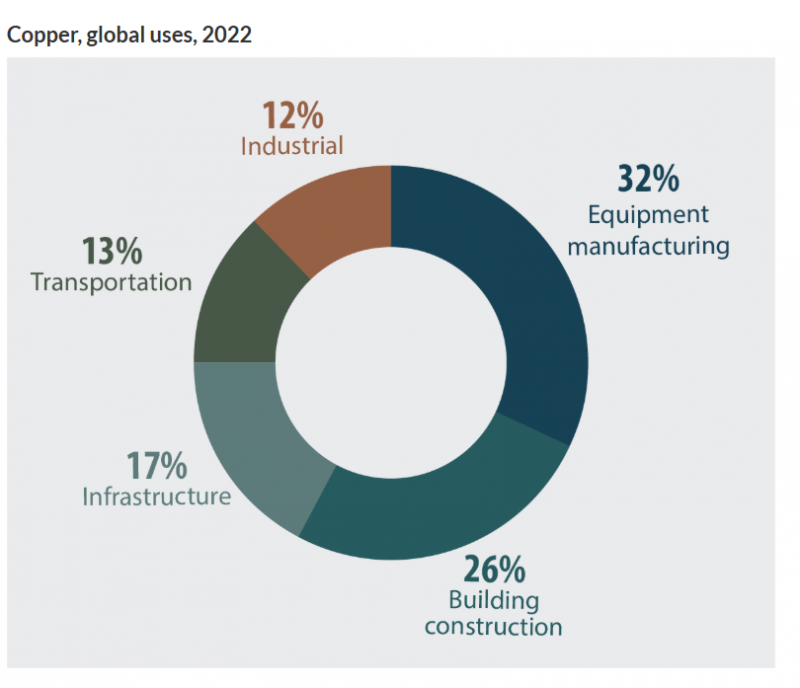

Critical uses of copper

Copper is indispensable in various industries beyond EVs. Here are some key examples:

- Construction: Nearly half of all copper supply is used in building construction. An average single-family home contains about 200 kg of copper. With the reconstruction efforts in California due to wildfires and the post-war rebuilding of Ukraine, the demand for copper in construction is set to increase significantly.

- Electronics: Copper’s high electrical conductivity makes it vital for electronics. It is used in wiring, circuit boards, and various electronic components.

- Renewable energy: Copper is essential for wind turbines, solar panels, and battery storage systems. A wind turbine uses around 3 metric tons of copper for every megawatt of power produced.

Why invest in copper now?

Investing in copper now is crucial for several reasons:

- Energy transition: Copper is a key component in renewable energy technologies and electric vehicles. The shift towards a greener future will drive copper demand.

- Infrastructure development: The global push for infrastructure modernization, including the reconstruction of homes and buildings, will require substantial amounts of copper.

- Supply constraints: The looming supply shortfall presents an opportunity for investors to capitalize on rising copper prices.

Examining this demand further, the IEA expects there will be a shortage of 25.9 million t/y by 2040 and according to commodities trading group Trafigura, the AI boom alone could amplify copper demand by 1 million t/y by 2030.

“Copper is as strategic as gold is precious.”

Mark Bristow, CEO Barrick Gold

How to invest in copper

The case for copper demand is clear, so how can investors take advantage? ETFs, futures trading, and buying copper bullion are all options, but arguably the greatest gain for investors lies in picking the hidden gems in mining stocks, and the junior venture markets provide an excellent opportunity to find these companies. Long decoupled from the senior exchanges, they have high value proposition as well as risk, although conceivably less risk than crypto currencies while potentially offering a greater return.

Grid Battery Metals: A focus on copper

One such stock to consider is Grid Battery Metals (TSXV:CELL). In a January 2025 report, Fundamental Research noted the company’s market cap of C$7 million nearly matches its cash balance of C$4.5 million, underscoring the market’s undervaluation of the company’s promising lithium and copper projects. The report valued the company 400% above its market cap.

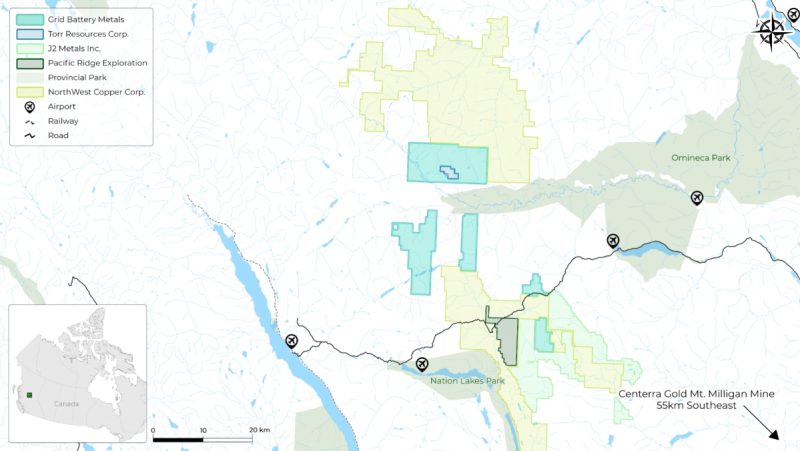

Grid’s copper property

The company’s recently acquired copper property in Northern Central British Columbia, a prodigious mining area in North America, comprises of 17 mineral claims over 275.2 square km. The province accounted for 45.8% of Canadian copper mine production in 2023.

Grid’s copper property is significantly important for several reasons:

- Location: The property is strategically located between two major mining projects; Centerra Gold’s Kemess North project and their Mt. Milligan mine which has produced 742 million lbs of copper and 1.8 million oz of gold.

- Infrastructure: The area has good mining infrastructure, including mining crews and equipment.

- Permitting: British Columbia and Canada are eliminating red-tape associated with permitting, making it easier to develop mining projects. Recent BC government changes have seen 18 mining and energy projects prioritized for faster environmental assessment and permitting with more to come.

Historically, the property has been covered by staking since the 1940s but has seen minimal exploration with little follow up due to downturns. The company is now finalizing its exploration plans, so investors should stay tuned.

In our previous deep-dive editorial into the company, we looked at how its Canadian copper projects provide a geographic hedge and a diversified portfolio. The long-term supply-demand dynamics for copper and the critical role of lithium in electrification make Grid Battery Metals a compelling investment opportunity.

Investor’s corner

The copper market operates on a global scale, with copper being traded worldwide based on its price per pound, a globally recognized dollar value. This means that copper is not dependent on good relations between specific countries, such as Canada and the U.S., especially given the current trade tensions between these nations.

Copper can be sold anywhere in the world, and buyers will purchase it based on its market price. Copper prices have steadily climbed, enjoying near 130 per cent growth over the past five years as it sells for just over US$5/lb. Analysts project that copper prices could reach US$6.15 per pound by 2026.

Investors should consider the significant supply-demand imbalance in the copper market and the essential role copper plays in electrification and various industries. Grid Battery Metals’ copper project in British Columbia presents a promising opportunity in this context.

Investors are encouraged to conduct thorough due diligence into Grid Battery Metals and its copper endeavors to make informed investment decisions. The global copper market dynamics and the company’s strategic initiatives make it a compelling prospect for those looking to invest in the future of electrification and sustainable energy.

Grid Battery Metals is a Canadian exploration company with a focus on exploration for high-value battery metals for the electric vehicle market.

Join the discussion: Find out what everybody’s saying about this stock on the Grid Battery Metals Inc. Bullboard investor discussion forum, and check out the rest of Stockhouse’s stock forums and message boards.

This is sponsored content issued on behalf of Grid Battery Metals Inc., please see full disclaimer here.

(Top image generated by AI.)